Guaranteed and assured rentals are a common feature of property investments today, with a myriad buy to let, student accommodation, vacation home and hotel room projects advertising attractive net yields, fixed and assured for a number of years. For the investor, this can feel reassuring; with comfort in the knowledge that their income should remain stable and that they need not worry about void periods, low occupancy or poor performance.

There are several questions you need to ask in order to ensure your rental assurance is worth more than the paper it might not even be written on.

Who is the guarantee with?

Usually the rental assurance will form part of a management, or operating contract, which is separate from the contract to buy your property. It’s important to find out as much as you can about the other party on this contract.

Often, the other party is a “management company” whose sole role is the management of the project in which you are buying and the distribution of the assured rental income. In this case, the security may be minimal and the guarantee flimsy. The guaranteeing company needs to have some means of backing up the promises they are making and that can’t be the case if they are a shell company, with no assets, trading history or track record.

Are they just giving you your own money back?

I remember a conversation with a client for a foreign property back in 2005. He had decided not to buy a holiday apartment from the development I was selling, but freely told me he had chosen one from a rival development, literally over the road. The other apartment had inferior amenities, the same location and was 25% more expensive per square metre. When I asked him why he was buying a seemingly overpriced apartment, he told me that it was simply because the other developer was offering a 3 year rental guarantee of 7%.

He just felt like the rental guarantee made him “safer.”

It should have gone without saying; don’t pay over the odds for a property and don’t let a rental guarantee persuade you that you should. You are only going to be receiving your own money back, after all in that case.

How are they going to afford to pay you?

A company offering a rental guarantee might already have funds in place to pay you, or they might be so confident of the property’s rental credentials that they are prepared to underwrite the rental performance and take on the risk of the actual rental. In the latter case, typically the company offering the guarantee is confident of a rental yield perhaps 1 or 2% higher than the guaranteed amount and so they have some wiggle room, in the event of a lower than expected performance.

It’s important to be careful here and be sure that the risk they are taking is realistic. If they are guaranteeing 8%, but your research shows you that this would be far higher than the market rent for that property – how is the developer or management company going to pay you if the company doesn’t meet their optimistic projections and falls well below the guaranteed level?

Some developers may choose to take their profit margin from the development by taking on the rental; therefore they can afford to set your guaranteed income aside, whilst they take their income when the property is actually rented. This means that the developer is actually taking on the risk of the rental performance directly and as long as your returns are held securely for you, then it’s a great and safe way for you to mitigate your risk during that initial rental period.

When will you be getting your money?

It’s not only important to calculate how much money you are receiving over the course of your investment, but also, when. 10% received in 10 years’ time is worth less in real terms, than 8% received today.

Money paid out earlier on not only has the advantage that it hasn’t suffered from inflation chipping away at it, but also, as long as you can earn interest on money, even at today’s rates, money is worth more, the sooner it is paid out. Make sure that a hefty looking percentage doesn’t make you overlook the fact that most of your income is going to be paid out in the distant future, leaving you unable to make it work for you elsewhere.

What happens if they don’t deliver?

Whilst we never enter into an investment with the intention of getting involved in messy litigation, you need to bear in mind that if, as a last resort, this becomes your only option, that you have a chance of recouping your money.

Does the contract adequately state the obligations of the company to pay the guaranteed return and does that provider have some assets to go after, if they renege on their clear and contracted obligations? If yes, then even if the situation gets to the worst case and you are left frustrated, you at least have a chance of using the courts to get some resolution and recompense.

Is the guaranteed return actually better than taking your chances?

It sounds obvious, but are you actually going to be better off by taking the guaranteed yield, rather than taking the actual rental return from the property?

Presumably you’d never go into a property investment without doing your own due diligence anyway and you’d need to be confident that your property would continue to perform after the guarantee period, so is the guarantee period actually helping you? If you know that your property is in an area of high demand, where high occupancies and rents will mean a high income, are you giving away some of your potential returns, in exchange for a perceived mitigation of risk?

Whether you take a guaranteed return or not, it’s essential to understand the dynamics which will drive the actual performance of the property, as this will also be directly related to your risk and the solidity of any promised returns.

Have you factored in inflation?

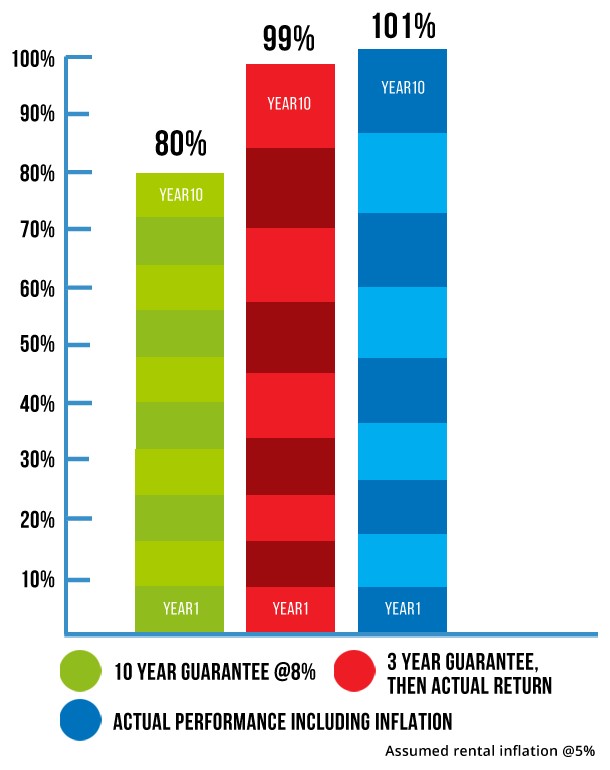

A longer term rental guarantee or assurance may sound perfect. You can relax, and wait for your money to come over the foreseeable future without worrying about fluctuation, but how much will that money actually be worth at the end of your guarantee period?

In the UK, as an example, because house prices continue to rise, staying out of the reach of potential first time buyers, more people are forced to rent, pushing up rental demand and therefore, rental prices. This may be bad news for first time buyers, but it is good news for landlords. Your rental income is likely to outperform inflation, if you allow it to do

so. If however your return is fixed as a % of the price you pay for your property at the beginning of your investment, you’re going to end up earning money which is devalued by inflation.

An 8% yield in 10 years might sound great, but you might feel disappointed in a decade, when your property is worth twice as much as you paid for it, but your rental income is the same as you were receiving when you first purchased.

Above is an illustration comparing how rental income over 10 years might perform, with 5% year on year increases in rent, against a 10 year or a 3 year rental guarantee.

So is a guaranteed or assured yield right for me?

Only you can answer that question. Guaranteed returns can be a reassuring and predictable way to receive your income, but they are not a means to shortcut proper due diligence and research. A guarantee is only worth anything if it can be backed up by facts, a firm contract, and by a company with assets, in the event of a “worst case scenario.”

At the end of the day, your best “guarantee” of success, is going to be your own effective due diligence and your ability to ask all the right questions before you commit to a purchase.

VascoWorldProperties have years of experience in finding high yield investment products for their clients. You can read further about safe guaranteed investments on This Page as well as keep up to date with their frequent property updates here @vascoupdates.

Be the first to comment on "How solid is your rental guarantee?"