Paragon Bank’s latest analysis casts a spotlight on the prime locations for buy-to-let investments, particularly for portfolio landlords holding four or more properties. The study, utilising the bank’s lending data, unveils a preference for areas rich in student populations and significant employment hubs.

Leading Destinations for Landlord Investments

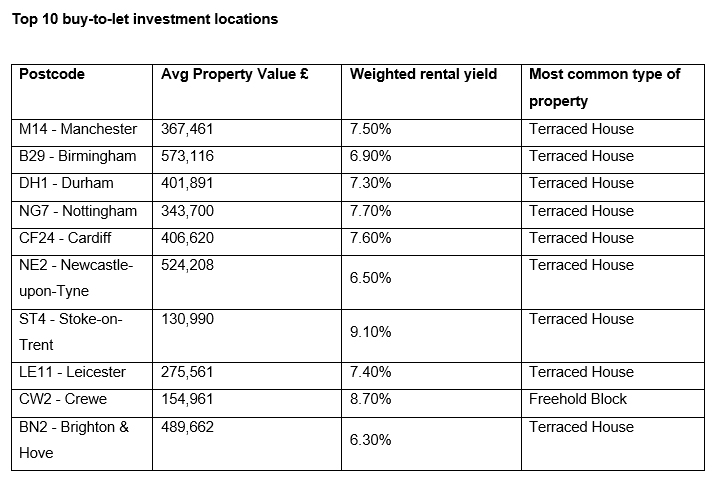

At the forefront of these buy-to-let hotspots is Manchester’s M14 postcode, which includes the Fallowfield, Rusholme, Old Moat, and Ladybarn districts. Its prime position between the University of Manchester and Manchester Metropolitan University makes it a magnet for landlords, offering potential rental yields up to 7.5%.

Birmingham’s B29 postcode, encompassing areas like Selly Oak and Edgbaston, ranks second. Home to Birmingham University and close to major employment centers like the Queen Elizabeth Hospital, this area is notable for its blend of student demand and professional tenants, with yields reaching 6.9%.

Durham’s DH1 postcode emerges as the third most sought-after location, promising up to 7.3% in rental yields. Its appeal is boosted by the proximity to the University of Durham, underscoring the consistent trend of landlords investing in student-populated areas.

Strategic Investment Choices

Richard Rowntree, Managing Director at Paragon Bank, reflects on the findings, noting, “Portfolio landlords have a strategy of targeting major towns and cities across England and Wales… This helps to illustrate the crucial role that the PRS plays in supporting further education provision and the workforce, both vital facets of the UK economy.”

The research also highlights terraced houses as the preferred property type among the top investment locations, with the exception of CW2 in Crewe, where landlords favour multi-unit freehold blocks of flats.

A Nationwide Scope

This geographical sweep from the south coast’s Brighton and Hove, through the Midlands and Wales, to Newcastle in the north, showcases the breadth of investment strategies deployed by portfolio landlords. By aligning their investments with areas featuring robust student populations and significant employment centers, landlords are strategically positioning themselves in parts of the UK where demand for rental accommodation remains strong.