The UK’s property market is currently experiencing its highest supply of homes for sale in eight years, according to Zoopla. This surge in availability is expected to keep house prices stable throughout 2024.

Sales and supply dynamics

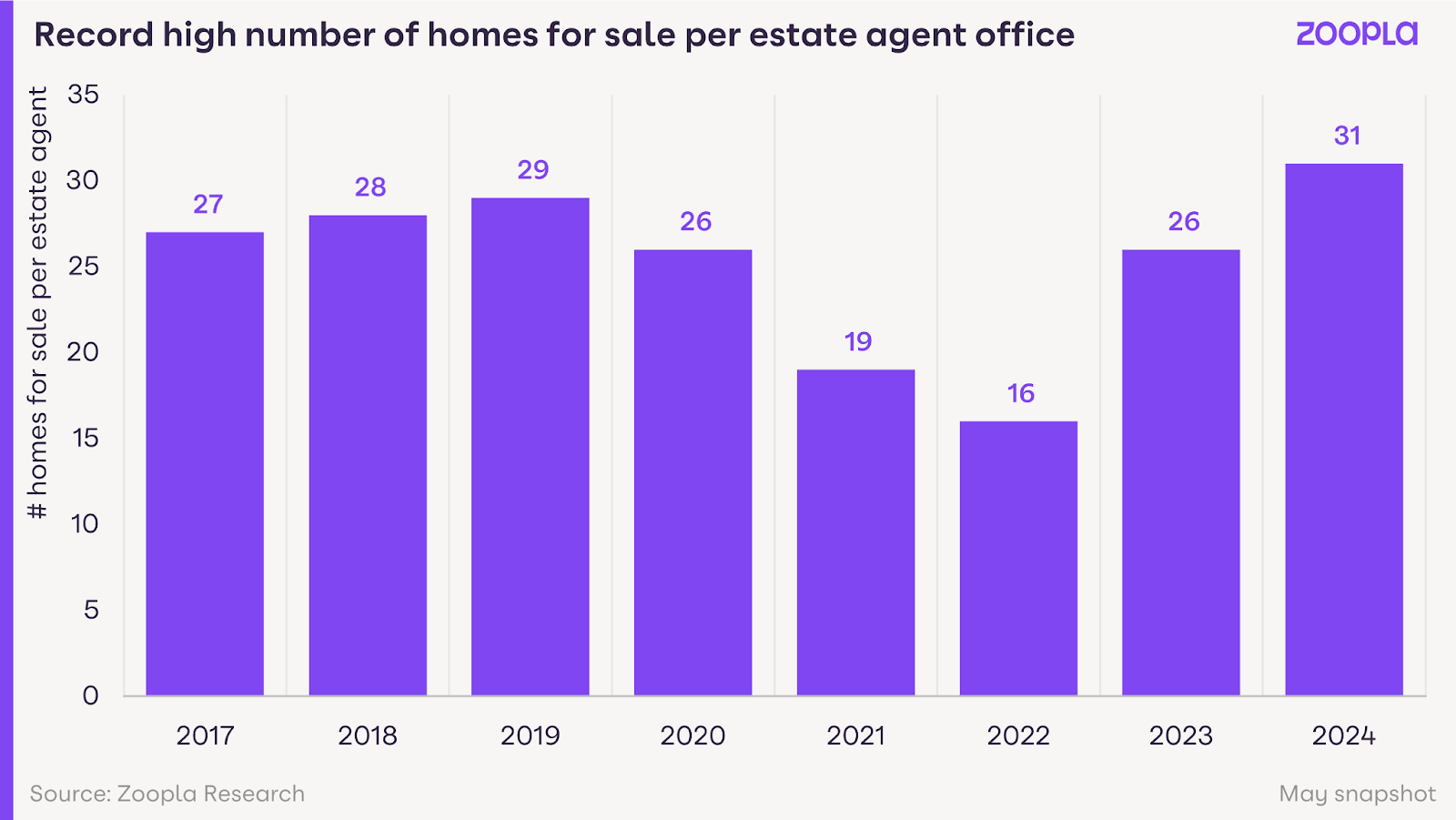

Recent data from Zoopla reveals that the supply of homes for sale is 20% higher than this time last year, amounting to £230 billion worth of housing, an increase of £45 billion. The average estate agent now has 31 homes for sale, the highest level in eight years. This surge is primarily driven by a rebound in the number of three and four-bedroom homes as existing owners feel more confident to move.

The increase in supply is outpacing the growth in sales, which have risen by 13% year-on-year. However, this imbalance is providing greater choice for home buyers and is expected to keep house price growth in check. Zoopla notes that 31% of homes currently on the market were initially listed in 2023, indicating a rise in re-listings as homeowners re-enter the market.

Regional disparities in house prices

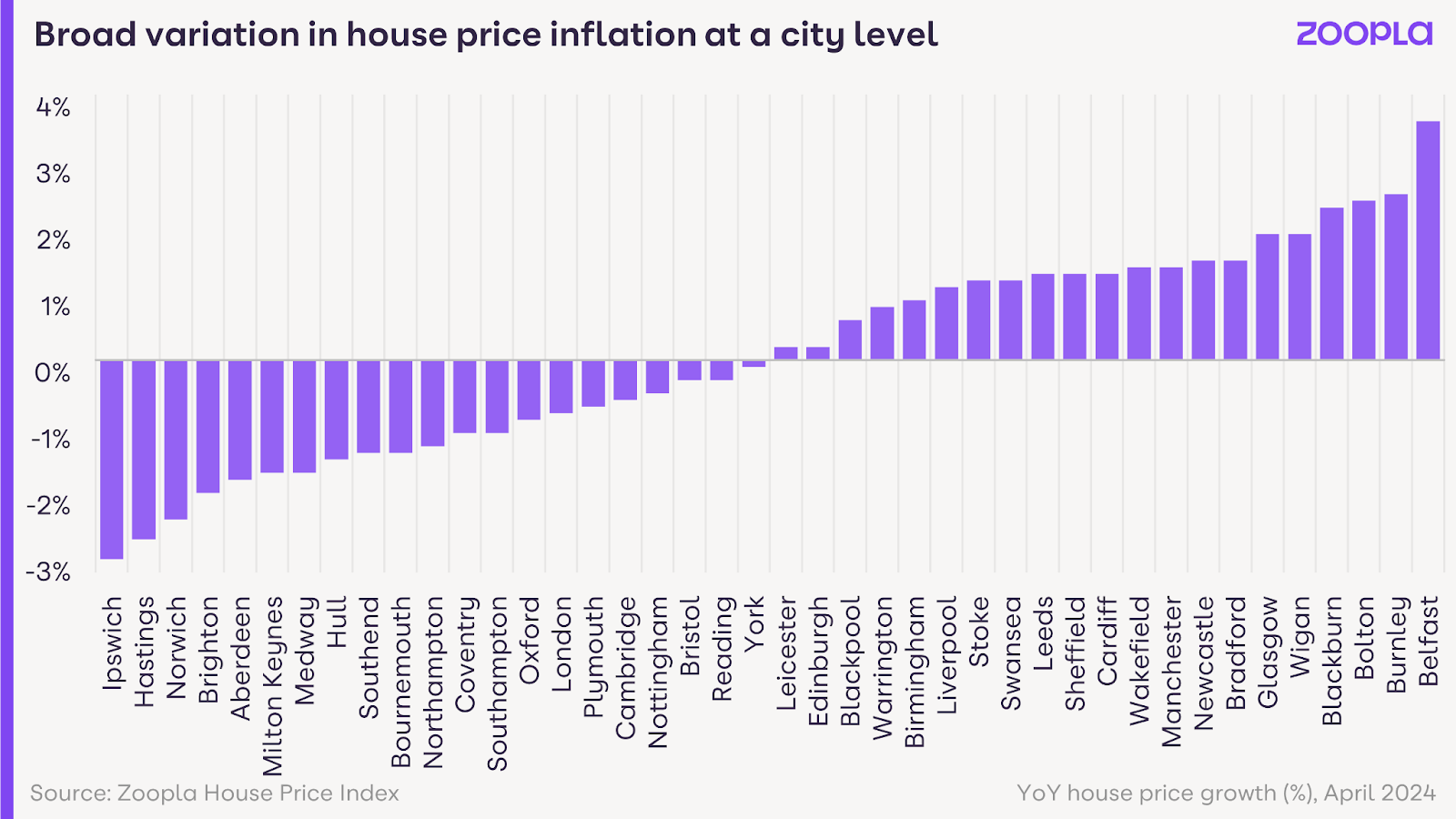

The regional variation in the UK housing market remains significant. The South West, for example, has seen a third more homes for sale compared to last year, influenced by tax and planning changes related to holiday lets and the potential for double council tax on second homes. This region, known for high levels of second home ownership, highlights the varied impacts across the country.

House price inflation currently stands at -0.1% across the UK. Cities like Belfast (+3.6%), Burnley (+2.5%), and Bolton (+2.4%) are experiencing growth, whereas Ipswich (-3%), Hastings (-2.7%), and Norwich (-2.4%) are seeing declines. This north/south divide is driven by affordability pressures and higher mortgage rates, with southern coastal cities and those that saw significant price jumps during the pandemic now experiencing weaker demand.

Impact of the upcoming general election

The upcoming general election on 4th July is anticipated to have a modest impact on the housing market. While some buyers may delay decisions, the underlying motivations to move remain strong. Richard Donnell, Executive Director at Zoopla, commented, “The growth in the supply of homes for sale is evidence of renewed confidence amongst homeowners, some of whom delayed moving decisions in 2023. The announcement of the election will slow the pace at which new sales are agreed while greater choice for buyers will keep house prices in check over 2024.”

Nathan Emerson, CEO of Propertymark, echoed this sentiment, noting, “With a general election now confirmed, until there is full clarity on the direction any new government intends to take regarding housing, we expect there to be a temporary slowing across the summer months of both people choosing to sell their property and those actively looking to buy. We do have the positive news that inflation is now firmly tracking downwards and would be keen to see interest rates follow.”

Expert insights and future outlook

Tom Bill, head of UK residential research at Knight Frank, emphasised the importance of realistic pricing in the current market. “Growing supply is one reason that UK house price growth this year will be limited to low single digits. However, the main obstacle for buyers is stubborn services inflation, which is keeping mortgage rates high. Asking prices therefore need to reflect the fact that buyers have more choice and tighter budgets.”

As the market adjusts to these dynamics, the record supply of homes is expected to play a crucial role in stabilising prices. The upcoming election and economic indicators, such as inflation data, will be key factors to watch in predicting future trends in the UK housing market.