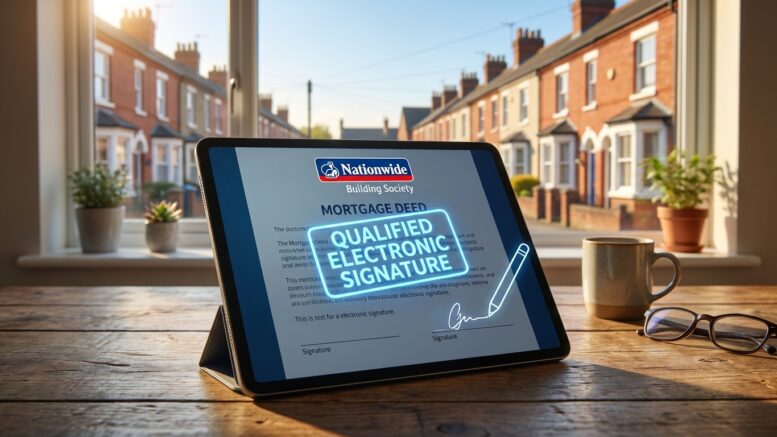

Nationwide Building Society has become the first UK lender to allow mortgage deeds to be signed electronically without requiring a witness, potentially cutting days off the remortgage process for buy-to-let landlords.

The move follows HM Land Registry’s decision in August 2025 to accept Qualified Electronic Signatures (QES) for mortgage deeds, replacing the traditional requirement for wet-ink signatures witnessed in person.

Digital signatures eliminate witness requirement

Landlords purchasing properties or remortgaging with Nationwide can now complete the deed signing process digitally where their solicitor or conveyancer supports QES technology. The change removes one of the final manual steps in an increasingly digital transaction process.

According to Nationwide, the electronic signature provides stronger consumer protection than traditional witnessed signatures. The QES system proves who signed the document, protects against tampering, and carries the same legal standing as a handwritten witnessed signature.

Henry Jordan, Nationwide’s group director of mortgages, said the building society is committed to reducing stress and inconvenience for borrowers. “Technology and collaboration are key to driving convenience, and that is why we’re delighted to have worked with HM Land Registry, Your Conveyancer and Veyco to become the first mortgage lender to allow electronic signatures on mortgage deeds,” he said.

Land Registry backs wider adoption

HM Land Registry has encouraged other lenders to follow Nationwide’s lead. Andy Roddy, deputy director of digital services at HM Land Registry, described the adoption as a “significant step forward for the UK property market” that sets a new standard for secure transactions.

“By embracing QES, Nationwide is not only enhancing security and speeding up the process for homebuyers but also paving the way for wider adoption across the market,” Roddy said.

The first transaction using the new system was a remortgage application processed through Your Conveyancer in partnership with electronic signature provider Veyco. The mortgage deed was sent for registration significantly faster than under the previous paper-based system.

For buy-to-let landlords managing multiple properties, the cumulative time savings could be substantial. The £49.7 billion refinancing wave expected over the coming years means many portfolio landlords will benefit from faster deed processing.

Full details of Nationwide’s QES implementation are available on the lender’s website.

Editor’s view

Conveyancing remains the biggest drag on property transactions, and anything that removes delays is welcome. Electronic deed signing may seem a small change but it eliminates scheduling hassles and postal delays at a critical point in the process. Expect other lenders to follow quickly – nobody wants to be the slow option when landlords are comparing refinance deals.

Author: Editorial Team – UK landlord & buy-to-let news, policy, and finance

Published: 11 February 2026

Sources: Nationwide Building Society, HM Land Registry

Related reading: Buy-to-let refinancing wave looms as £49.7bn in mortgages mature