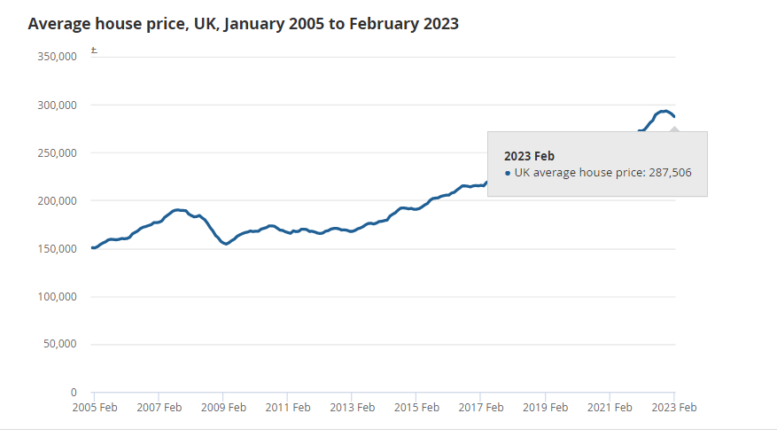

House prices in the UK have experienced a decline for the third consecutive month, with a 0.3% decrease between January and February. The average house price reached £288,000, up 5.5% from the previous year but £5,000 lower than November’s peak. Despite this, experts maintain hope for a soft landing.

Sarah Coles, head of personal finance at Hargreaves Lansdown, said, “The descent has picked up pace very slightly, and we can expect more falls from here – but there is still the glimmer of hope for a soft landing.” She added that mortgage approvals for future purchases had started to recover, showing that “there’s still some life left in the market.”

Nicky Stevenson, Managing Director at national estate agent group Fine & Country, commented, “All signs point to a strong showing for the property market over the next few months, in what is traditionally a very busy period.” She also highlighted that first-time buyers are returning, undeterred by the end of the Help To Buy Scheme.

Iain Crawford, CEO of Alliance Fund, mentioned that new-build house prices were moving “against the wider grain of a cooling market,” while Nigel Purves, Co-founder and CEO of Wayhome, warned that despite the recent drop in house prices, homeownership remains out of reach for many aspirational buyers.

Other experts also discussed the effects of higher interest rates on the market and advised potential buyers and sellers to focus on local market performance rather than general market statistics.

ONS House price data for February was released yesterday: UK House Price Index: February 2023 – Office for National Statistics (ons.gov.uk)

Land registry data for February was also published: UK House Price Index: reports – GOV.UK (www.gov.uk)