A slight fall in the annual rate of house price inflation was detected by the Halifax last month.

‘While house prices have so far proved to be resilient in the face of growing economic uncertainty, industry surveys point towards cooling expectations across the majority of UK regions, as buyer demand eases’, said Halifax Mortgages director Kim Kinnaird. ‘And other forward-looking indicators also imply a likely slowdown in market activity’.

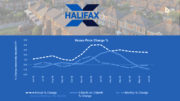

The annual rate of price increase was still put at 11.5 per cent in August – down from 11.8 per cent in July. The month-on-month increase was 0.4 per cent, ‘relatively modest compared to the rapid inflation we’ve witnessed in recent times’.

Over the last year the rate of monthly house price inflation has averaged around 0.9 per cent.

There is no shortage of reasons for moderation in house price rises. There has been a considerable hit to people’s incomes from the cost-of-living squeeze, said Kinnaird. And the 80 per cent rise in the energy price cap for October will put more pressure on household finances, as will the further increases expected for January and April.

‘At the levels being predicted, this is likely to constrain the amounts that prospective homebuyers can afford to borrow, on top of the adverse impact of higher energy prices on the wider economy.

‘While government intervention may counter some of these impacts, borrowing costs are also likely to continue to rise, as the Bank of England is widely expected to continue raising interest rates into next year.

‘With house price to income affordability ratios already historically high, a more challenging period for house prices should be expected. However, this should be viewed in the context of the exceptional growth witnessed in recent years, with average house prices having increased by more than £30,000 over the last 12 months alone’.

Wales remained at the top of the Halifax table for annual house price inflation, up to 16.1 per cent in August, the strongest level of growth since early 2005.

The South West of England also continued to record a strong rate of annual growth, up by 14.5 per cent.

The rate of annual growth in Northern Ireland eased back to 12.5 per cent, and Scotland also saw another slowdown, this time to 9.4 per cent.

While London has continued to lag behind other nations and regions, the rate of annual house price inflation in London rose again to now stand at +8.8%, its highest level in over six years. With a typical property costing a record £554,718 the capital’s average house price has risen by £44,669 over the last 12 months.