New data from SpareRoom shows room rents in Wales rising almost three times faster than the UK in the past year, driven by sharp increases in Cardiff and deepening supply shortages – a trend that continues to shape rental yields and investment decisions for landlords across the country.

Room rent growth outlook shaped by Welsh hotspots

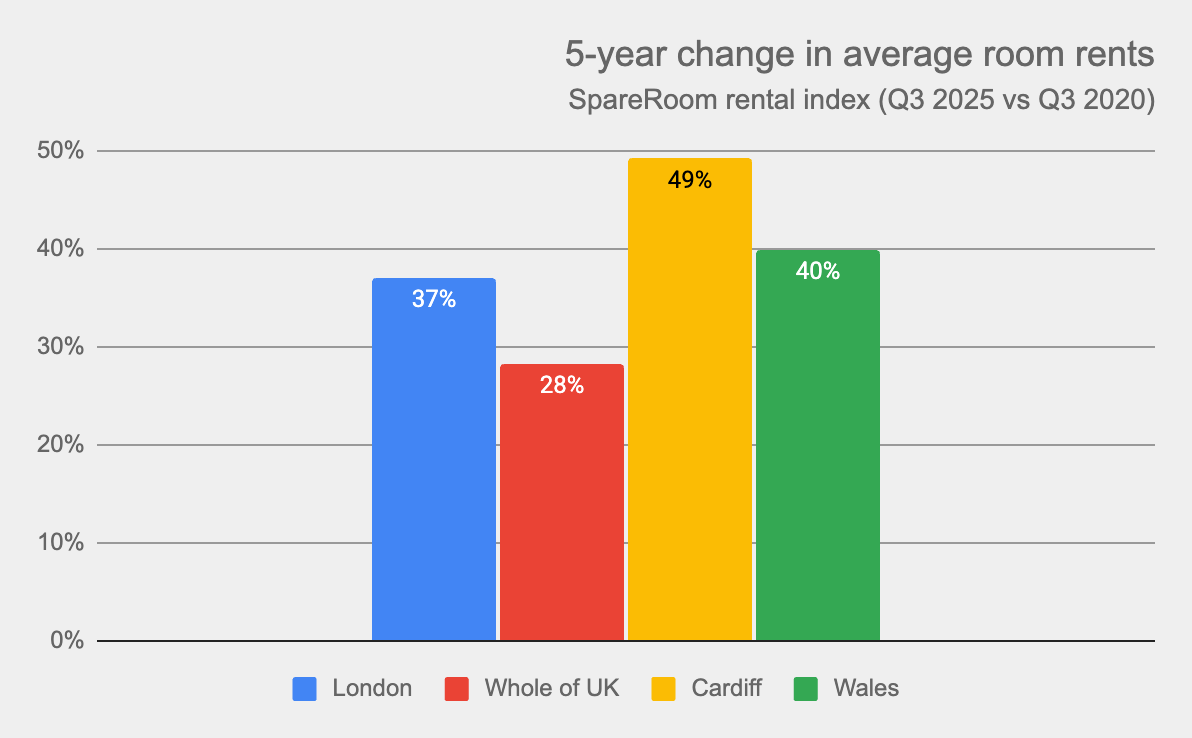

Over the past five years, room rents in Wales have climbed 40 percent, jumping from £419 to £586 per month, while the UK average rose 28 percent in the same period, according to SpareRoom’s rental index. For tenants, that translates into an extra £167 per month – or £2,004 per year – just to stand still. For landlords, however, the figures underline an increasingly favourable environment for rental returns where supply continues to lag demand.

In Q3 2025, Wales recorded a 2.3 percent annual rise in room rents, nearly triple the UK-wide increase of 0.8 percent. The standout driver remains Cardiff, where rents are up 5 percent year on year, far outpacing cities such as Edinburgh (which saw a 4 percent fall) and even London, where rents held flat.

Five-year growth in Cardiff has reached 49 percent, with room rents rising from £443 to £661 per month – a trajectory that began accelerating in mid-2021 as post-pandemic restrictions lifted and demand rebounded at speed. Letting agents in the Welsh capital report conditions where “every listing receives multiple applicants within hours,” reflecting a deep structural imbalance.

Regional rent trends highlight opportunities for landlords

Wales’s three largest rental markets – Cardiff, Swansea, and Newport – continue to display shifting dynamics. Newport overtook Swansea in Q1 2024 for the first time since 2021 and has maintained the lead ever since. Average room rents now stand at £575 in Newport, around 7 percent higher than Swansea’s £539.

For buy-to-let landlords weighing regional strategy, the divergence offers a practical insight: markets where affordability once suppressed rent growth are now catching up rapidly as supply thins. ONS data from earlier this year recorded some of the fastest regional rental increases in Wales, particularly across Cardiff and Newport – developments that align with SpareRoom’s findings and highlight a broader UK trend of renters staying longer, moving less often, and competing harder for available homes.

Letting agents operating in the South Wales corridor say the market is “stretched to levels unseen in at least a decade,” with family homes and HMO rooms both seeing accelerated demand since early 2023.

Demand outstripping supply as landlords fill the gap

Perhaps the most striking data point is SpareRoom’s estimate that 3.8 renters are competing for every available room in Wales – a ratio of nearly 4:1. While supply temporarily peaked in January 2025 (typically the busiest month for new listings), inventory remains far below pre-pandemic baselines.

With many private landlords constrained by higher borrowing costs and increased compliance expectations, an unexpected group has emerged as a stabilising force: lodger landlords. In 2025, 32 percent of all Welsh flatshare listings came from households renting out spare rooms, compared with 24 percent across the UK. For the wider sector, this additional capacity helps prevent rents climbing even more steeply.

Matt Hutchinson, director at SpareRoom, explains the pressure facing renters:

“The decline of affordable housing, coupled with weak wage growth and the high cost of living, is pushing more people into the flatshare market, putting immense pressure on already limited supply.”

He adds that pandemic-era volatility permanently shifted rent levels upwards: “They never came back down again because demand has always outweighed supply. Without households renting rooms to lodgers, demand in the Welsh rental market would be far more intense and average rents would be higher.”

For landlords, these dynamics reinforce a simple investment truth: where supply remains constrained and households continue to outnumber available rooms, rental markets become more resilient, particularly in regional cities with growing student and young professional populations.

Editor’s view

Wales’s rental trajectory is fast becoming a case study in how constrained supply, pockets of regeneration, and demographic pressure combine to push rents far beyond national averages. This raises an important strategic question for landlords: will tightening policy in England accelerate investment into Wales, where demand remains robust and yields are strengthening? The next year may tell us whether this regional rebalancing becomes a long-term shift – or simply a snapshot of a market struggling to house a growing tenant base.

Author: Editorial team – UK landlord & buy-to-let news, policy, and finance.

Published: 16 December 2025

Sources: SpareRoom data; ONS rental index; letting agent market commentary

Related reading: Rent growth slows as supply rises but investors eye 2026 uplift