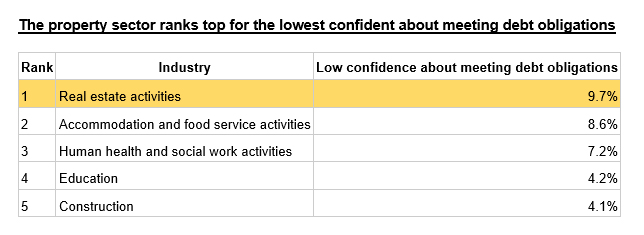

As the Autumn Budget looms and fears of a potential capital gains tax hike grow, new research reveals that the property sector is grappling with the lowest confidence in meeting debt obligations compared to any other industry. Rising interest rates, economic uncertainty, and increased costs are creating a financial strain that many real estate businesses may struggle to overcome in the coming months.

Real estate sector hit hardest

Data analysed by business experts at Sopro, using ONS figures, show that 9.7% of businesses in the real estate sector have low confidence in meeting their debt obligations this autumn. This is the highest rate among all industries, reflecting the growing challenges faced by property companies. The research highlights that the sector has also seen a 20.5% increase in operating costs, further adding to the pressure on revenues.

The slowdown in house sales has worsened the situation, causing a drop in income and forcing many businesses to consider redundancies. The report predicts that 4.2% of real estate firms will make staff cuts to stay afloat.

Tips for navigating the financial slump

Steve Harlow, Chief Sales Officer at Sopro, offers advice on how property businesses can weather the storm this autumn. He stresses that while rising costs are impacting finances, “innovation and expanding your customer base are key to remaining competitive and achieving long-term business success.”

Harlow provides practical strategies for businesses to implement during these challenging months:

- Maximise prospecting efforts: “Ramp up your prospecting and lead generation efforts as we enter the quieter months of the year to identify new potential clients and proactively drum up business. Use targeted outbound marketing such as emails, phone calls, and social media messaging.”

- Analyse your sales funnel: “Monitor the success of your prospecting and lead generation to make swift adjustments. Regularly evaluate your leads and customer experience to identify areas for improvement and adjust your strategy accordingly.”

- Adapt to the seasonal shift: “Embrace the seasonal shift by incorporating seasonal messaging and deals into your marketing and sales efforts to bolster interest.”

By adopting these tactics, businesses can keep customers engaged and generate a steady stream of sales, helping to mitigate the financial impact of the current economic climate.

Uncertainty around capital gains tax

The timing of the Autumn Budget is critical for the property industry, with many landlords and investors worried about potential increases in capital gains tax under Labour’s proposals. If implemented, these changes could add further financial strain to a sector already battling rising interest rates and economic uncertainty.

As businesses across the UK brace for the upcoming Budget, the real estate sector’s concerns over debt, rising costs, and the need for redundancies highlight the fragility of the property market. How well businesses adapt to these pressures could determine their survival in a rapidly changing landscape.