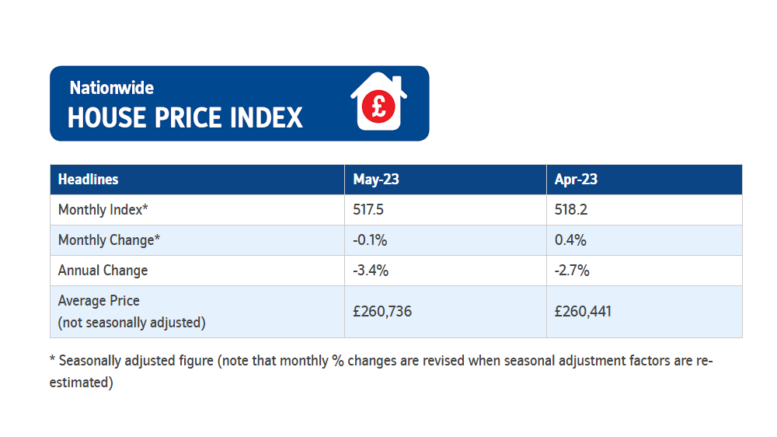

May witnessed a minor 0.1% decrease in house prices following a slight uptick in April after seven consecutive months of decline. On an annual scale, house prices fell by 3.4% up to May, and the average house price is now £260,736, which is 4% lower than the peak seen in August.

Sarah Coles, Head of Personal Finance at Hargreaves Lansdown, commented: “Although house prices experienced a minor decline in May, this could be just the beginning if mortgage rates continue to rise. The change is mainly due to the seasonal adjustment, but it’s the future trend that is of most concern.”

Coles added, “While confidence had been building slowly in the property market this spring, higher core inflation figures have raised expectations that interest rates may have to keep rising. This has led to numerous mortgage products being withdrawn from the market and major lenders increasing their rates. It may well have brought confidence crashing down.”

However, she also pointed out that this might not mirror the aftermath of the mini-budget and the market hasn’t been as deeply affected. She foresees a potential overreaction and a possible reduction in rate expectations.

Nathan Emerson, CEO of Propertymark, shared his insights on the release of Nationwide’s latest House Price Index, noting that the number of properties for sale is returning to pre-pandemic levels due to an increase in market appraisals. However, a fall in buyer demand has allowed homes available for sale to recover from the surge seen during the pandemic.

Marc von Grundherr, Director of Benham and Reeves, said, “While buyer interest is returning to the market, it’s not converting at the same rate due to increasing interest rates, causing house prices to stutter.”

James Forrester, Managing Director of Barrows and Forrester, highlighted that the market has been treading water where house price growth is concerned. With another interest rate hike likely this month, he expects this subdued performance to persist over the coming months.

Chris Hodgkinson, Managing Director of House Buyer Bureau, spoke about the inconsistent market performance this year, stating that it’s creating uncertainty for homebuyers and sellers who are trying to negotiate prices. Consequently, transaction timelines have been extended, and there’s a higher risk of sales falling through.

Nationwide published its House Price Index for May 2023: Annual house price growth slips back in May (nationwidehousepriceindex.co.uk)