House prices fell slightly last month, the Nationwide has reported.

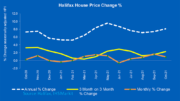

Its March survey puts prices down 0.2 per cent on February, compared with a rise of 0.7 per cent between January and February. The annual rate of increase slowed from 6.9 per cent to 5.7 per cent.

‘Given that the wider economy and the labour market has performed better than expected in recent months, the slowdown in March probably reflects a softening of demand ahead of the original end of the stamp duty holiday before the Chancellor announced the extension in the Budget’, said Nationwide’s chief economist Robert Gardner.

‘Recent signs of economic resilience and the stimulus measures announced in the Budget, including the extension of the furlough scheme and the stamp duty holiday, as well as the introduction of a mortgage guarantee scheme, suggest that housing market activity is likely to remain buoyant over the next six months.

‘The longer-term outlook remains highly uncertain. It may be that the recovery continues to gather momentum and that shifts in housing demand resulting from the pandemic continue to lift the market. However, if the labour market weakens towards the end of the year as policy support is withdrawn, as most analysts expect, then activity is likely to slow nearer the end of 2021, perhaps sharply’.

England was the weakest performing home nation in the three months to March 2021, with annual house price growth of 6.4 per cent.

Of the regions, the North West was the strongest performing, with prices up 8.2 per cent year-on-year: the strongest price growth seen in the region since 2005.

London was the weakest performing region, with annual price growth ‘softening’ to 4.8 per cent from 6.2 per cent in the last quarter of 2020.