Another indication of continued house price growth has come in the latest Halifax house price survey.

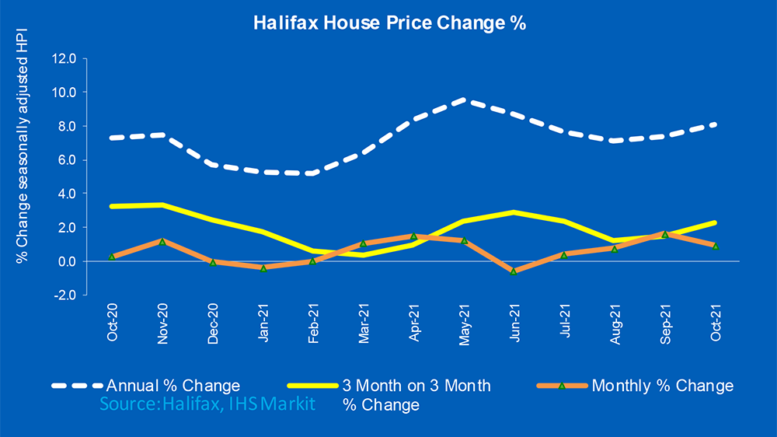

It puts the current average UK house price at just over £270k (compared to the Nationwide’s £250k), the October rate of increase at 0.9 per cent (0.7 per cent according to the Nationwide) and the annual rate of uplift at 8.1 per cent (9.9 per cent said the nationwide).

So while there is a divergence in the details emerging from the two mortgage lenders’ surveys, the is no disagreement about the trends – which is up.

According to the Halifax prices increased by 2.3 per cent, over £6k, over the last three months alone.

‘With the Bank of England expected to react to building inflation risks by raising rates as soon as next month, and further such rises predicted over the next 12 months, we do expect house buying demand to cool in the months ahead as borrowing costs increase’, said Halifax managing director Russell Galley.

‘That said, borrowing costs will still be low by historical standards, and raising a deposit is likely to remain the primary obstacle for many.

‘The impact on property prices may also be tempered by the continued limited supply of properties available on the market.

Wales remained the strongest performing nation or region with annual house price inflation of 12.9 per cent (making the average house price of £198,880), said the Halifax.

Northern Ireland last month recorded its strongest growth in four months (11.3 per cent, making the average house price of £169,308). House prices also continue to rise in Scotland, with the average property now up 8.6 per cent year on year (and the average house price of £190,023).

In England, the North West has returned to being the strongest performing region (10.4 per cent, average house price of £205,881), a four-month high. London remains by far the weakest performing area of the UK (with annual inflation of 0.8 per cent, the lowest year-on-year rise in prices since February 2020, and average house prices at £514,907).