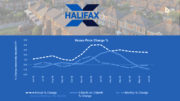

House prices remained relatively unchanged in May, with a slight 0.1% decline following a 0.1% rise in April, according to the Halifax House Price Index. The annual increase stands at 1.5%, bringing the average house price to £288,688. As political parties gear up for the upcoming election, property policies have taken centre stage, with Labour and Conservative proposals aiming to address the challenges faced by first-time buyers.

Election campaigns highlight property policies

Labour recently announced policies to support first-time buyers, including making the mortgage guarantee scheme permanent, rebranded as “Freedom to Buy”. This scheme, introduced by the Conservatives in 2021, helps first-time buyers secure mortgages with low deposits by guaranteeing part of the loan. Labour’s plan promises to help 80,000 young people get onto the property ladder in the next five years. Additionally, Labour has proposed planning reforms to facilitate the construction of an extra 1.5 million homes.

In contrast, the Conservatives have focused on council tax and stamp duty, pledging not to revalue council tax, increase the number of tax bands, or cut discounts. They have also promised not to raise stamp duty. Sarah Coles, head of personal finance at Hargreaves Lansdown, remarked, “The election campaign has moved into the property market, and started blowing the dust off housing policies.”

Challenges for first-time buyers

Despite political pledges, first-time buyers continue to face significant hurdles. Mortgage rates have risen, with Moneyfacts reporting the average rate on a two-year fixed deal now at 5.95%, the highest in 2024. Coles commented, “Mortgage deals are reflecting the fact that interest rates are likely to stay higher for longer. It’s still bad news hitting at a time when buyers were hoping for something more positive.”

The high cost of buying a home is further compounded by affordability issues. The proportion of gross earnings spent on rent is at a decade-high across all regions, ranging from 41% in London to 21% in Scotland. This disparity highlights the struggle for those trying to save for a deposit while managing high rental costs.

Industry insights on market stability

Industry experts have noted the stabilisation in the property market despite these challenges. Daniel Austin, CEO and co-founder at ASK Partners, observed, “The property sector is recovering. Rent values have seen sustained growth, positioning real estate as reasonably valued in comparison to gilts and presenting growth potential.”

Guy Gittins, CEO of Foxtons, noted the positive market momentum: “Today’s house price figures provide further proof that the UK property market is in great form. We now look set for a summer of sustained market activity.”

Verona Frankish, CEO of Yopa, added, “The property market looks set to enjoy a summer of stability with buyers and sellers having adjusted to the new norm with respect to current mortgage rates.”

Future outlook for the rental market

The outlook for the rental market in 2024 remains cautious, with a projected slowdown in rental growth to 5%. Richard Donnell, Executive Director at Zoopla, highlighted the need for increased housing supply: “Growing the supply of rented homes, both private and affordable, should be among the top housing priorities for the next Government. A healthy private rented sector is vital for economic growth and a more balanced housing market.”

Marc von Grundherr, Director at Benham and Reeves, echoed this sentiment, advising potential sellers to prepare: “With the additional boost of a rate cut imminent, now is the time to get your house in order if you’re planning to sell your home in 2024.”

Navigating a complex market

As the UK property market stabilises, first-time buyers continue to face significant challenges due to high mortgage rates and affordability issues. The upcoming election brings promises of policy changes aimed at alleviating some of these pressures. For landlords, the focus remains on increasing housing supply to meet the ongoing demand while balancing new regulations and market conditions. As the year progresses, the market will be closely watching the impact of political decisions on housing and affordability. For landlords, staying informed and adaptable will be key to navigating the evolving landscape.