Even amid the Coronavirus turmoil, landlords should remember that there are important legal changes coming into effect this year – some even this month.

These include previously set deadlines to the rules on Energy Efficiency Standards and certificates, on Electrical Appliance safety checks and certificates, and on the tax treatment of landlords, including those affecting mortgage interest payments.

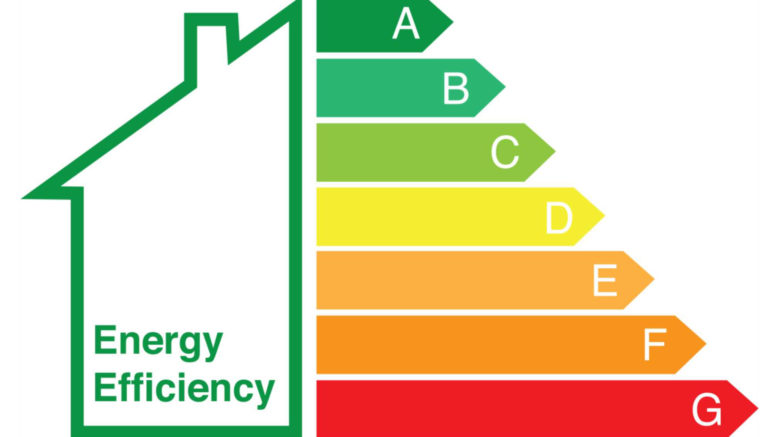

Energy efficiency

Regulations passed in 2015 require private landlords to provide tenants with an Energy Efficiency Certificate (EFC) for the property being rented. Where the rating shown is below ‘E’, landlords are expected to make necessary improvements – a cap of £3,500 was subsequently placed on their own financial contribution to this. Other finance is available via loans and grants.

This requirement was introduced in stages. From April 2018 the rules applied to new tenancy agreements, although landlords could ask for exemption for a maximum of five years – one of the grounds for exemption being ‘high cost’. After five years, landlords may re-apply although to obtain continued exceptions they will need to show that improvement in energy efficiency is still not possible.

New landlords may apply for a temporary six-month exemption from improvements.

In the case of continuing tenancy agreements, landlords of non-exempt properties had until 1 April this year to make any necessary improvements.

As of this month, new and existing tenants of non-exempt properties must be provided with an EFC with a rating of ‘E’ or above.

Local authorities are charged with ensuring compliance with the requirements. Non-compliance could result in fines of up to £5,000 per property.

There is further government guidance is available online about minimum levels of energy efficiency in rented properties and specifically for landlords on how to comply with the regulations.

EPCs and the coronavirus crisis

Lockdown requirements not withstanding, it remains the law that where property is let ‘all reasonable efforts’ must be made to obtain a valid EPC within seven days of the property being put on the market.

The reminder, contained in new government guidance, also tells landlords that if all reasonable efforts have been made to obtain a valid EPC but this has not been possible, a further 21 days is allowed as a grace period. But it warns that :’After this period, enforcement action can be taken by enforcement authorities in line with the EPB Regulations’.

Of course, the Government would prefer that all house moves and new tenancies are put off wherever possible. Many properties will already have a valid EPC, but if a new one is required, assessments should only be conducted in accordance with its guidance on the subject and where EPC assessments can be conducted safely.

Further information on energy efficiency standards >>>

Schedule D income tax

From the start of this financial year, landlords’ tax deductions for their mortgage interest costs will be restricted even further.

Once landlords could claim mortgage interest in full as a deduction from income. This changed in 2017 when the deduction was limited to the standard rate only (currently 20 per cent). Under this new system, mortgage costs are not allowed as a straight deduction from taxable letting profits. Instead, once the income tax on profits has been worked out, the liability is reduced by a ‘tax reduction’ – which in most cases is the basic rate value of the finance costs.

To ease the transition for those who are or are potentially higher rate tax payers, the change was phased in over four years.

This meant the percentage of finance costs deductible from rental income was reduced progressively from 75 per cent in 2017/2018 to zero in the current, 2020/2021 tax year. At the same time percentage of basic rate tax reduction – the new and less generous way of working out the allowance for mortgage interest and other finance costs – was increased from 25 per cent to the current 100 per cent.

The change affects schedule D tax payers – basically individuals and partnerships, but not limited companies – and all finance costs including those associated with loans such as those needed to acquire furniture, overdrafts, and alternative finance. In addition to interest, the finance costs covered include fees and costs incurred in obtaining or repaying finance, and interest paid under another name.

As Schedule D is assessed in arrears, this year’s change will not be reflected in actual payments until next year.

Schedule D and the coronavirus crisis

Those due to pay a second self-assessment payment on account by 31 July 2020 who have been adversely affected by the Coronavirus crisis may defer payment until January 2021. No application is required and there will be no penalties or interest for late payment provided payment is made by 31 January 2021. Further help is available from HM Revenue and Custom’s Time to Pay Scheme

Electrical safety

New this year, the Electrical Safety Standards in the Private Rented Sector Regulations 2020, become applicable to all new tenancies from 1 July 2020.

Under the regulations, private landlords are required to ensure that electrical safety standards are met during any tenancy. This is to be certified by way of an Electrical Safety Condition Report (EICR) prepared by a suitably qualified person.

Inspection and testing will cover ‘fixed electrical cables or fixed electrical equipment located on the consumer’s side of the electricity supply meter’, rather than appliances. If the report indicates that investigative or remedial works are necessary, landlords are required to have this work carried out.

Landlords are required to provide an EICR to new tenants, and to the local authority if requested.

Electrical safety and the coronavirus crisis

Landlords will not be in breach of the new electrical safety regulations provided they can show they have taken all reasonable steps to comply. To do this, landlords must be able to show they have taken such steps by providing copies of all communications they have had with their tenants and with engineers in their attempts to arrange for the necessary work.

Landlords may also wish to provide other evidence they have that the electrical installation in the rental property is in a good condition at the time they have attempted to arrange works.

Be the first to comment on "Crisis or not, law moves on"