The gradual introduction of Universal Credit from 2013 has brought many issues for both landlords and tenants, not least Council Tax liability.

Landlords, social as well as private, found their arrears levels rising under Universal Credit; tenants who had always asked that their rent be paid direct to the private landlord, now found this was not allowed without a reason for this happening, such as alcoholism or drugs; it was not sufficient reason to say they had never had the experience of having to budget from a single payment.

Enough has been said about that; some of the issues have brought amendments to how it was first planned, most popularly, for landlords who can now expect to get some re-payment of the arrears by deductions from the tenant’s remaining benefits.

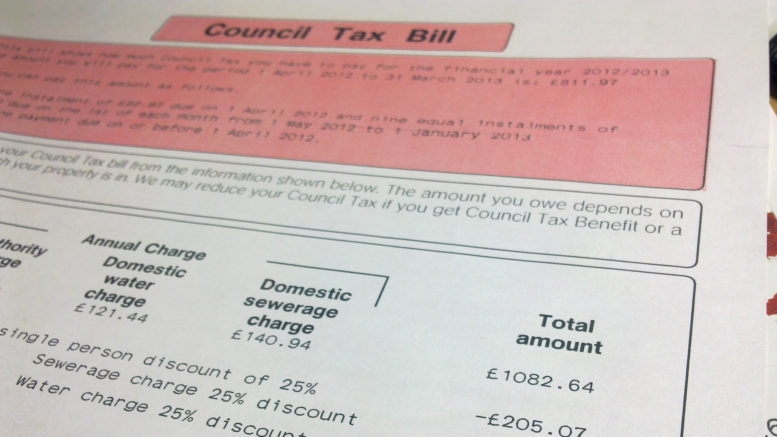

But Universal Credit was not the only change at that time. Universal Credit and the housing element in it had become a national scheme; this meant that Council Tax, which was a local scheme, had to be dealt with separately; the Local Government Finance Bill enacted on 1st November 2012, became operational from 1st April 2013.

For the benefit dependent, used to completing one housing benefit application which incorporated a Council Tax claim form, this meant an additional task in applying for Council Tax separately. It was difficult to understand for some tenants that their application for Universal Credit had no connection to council tax; that the fact they had applied for Universal Credit would not flag-up that a Council Tax application was needed. In addition, even those entitled to Council Tax credit would find that they were expected to pay a small amount themselves.

A landlord contacted me in some distress. His tenant had paid no Council Tax for quite some time; he was an alcoholic and spent every spare penny he had on booze. He was threatened with court by Council Tax and at that stage, felt he should speak to the landlord – who was a close relative and quite a well-respected person in the locality.

The landlord was appalled. He did not want his tenant being dragged through the Court and perhaps seeing his name, as the landlord, in the local newspaper, so he spoke to Council Tax. They could not discuss it with him, but suggested he evict the tenant. He would have to go through the full eviction procedure, which may be reported, which the landlord wanted to avoid.

The medical condition of the tenant and the abuse he had subjected himself to meant that a sheltered accommodation, with some element of support, may have been appropriate – but he could not get this without being made homeless and if he was to avoid making himself intentionally homeless, then he would have to stay where he was until a court ordered possession.

It went against the grain, but I had to advise that the landlord might find it less stressful to pay to get the tenant to go, perhaps paying the deposit for somewhere else. Fortunately, the tenant had registered with Council Tax; therefore, he had accepted liability for the Council Tax. Had he neglected to do so, the liability would have remained with the landlord.

The tenancy agreement should be clear who is responsible for the Council Tax and that they are aware they need to register for it – and you can do it yourself, to ensure that it is done.

As for the tenant in debt in this case? With the problems he had, a better option would have been a house in multiple occupation where the outgoings for the tenant are low and the landlord pays the Council Tax. But the best advice is always – don’t rent to family and friends, especially not if they have problems. You may think you’re being kind, but you are left with the problems when it goes wrong.

For advice on buy to let issues – General Knowledge

Be the first to comment on "Council Tax Liability – Be Clear Who Pays"