After years of pressure from inflation, tax hikes and tighter development rules, the UK’s commercial property market is showing early signs of renewed strength. Fresh figures from CBRE show capital values rose by 0.3% in March 2025, rental values edged up 0.4%, and monthly returns hit 0.8%. Landlords and property investors now have good reason to pay close attention.

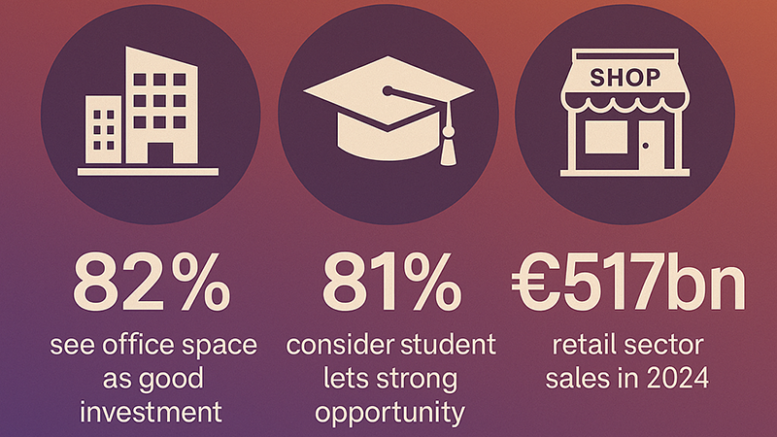

According to a new report from specialist lender Together, Cities in Focus 2025: Commercial Property Insights, three sectors are driving this resurgence-student accommodation, office space and retail. Each is buoyed by structural changes in demand and fresh investor appetite. Crucially, 82% of surveyed property professionals, developers and investors believe that office space represents a strong investment opportunity over the next five years.

The new era of offices: Adapting to hybrid work and wellness needs

With the shift back to office working post-Covid, demand is growing for workplaces that reflect modern professional priorities. Businesses are actively targeting buildings with hybrid flexibility, wellness amenities and tech-ready infrastructure. Together’s research found that 41% of respondents cited modernisation and technological upgrades as key trends in office development, with 38% highlighting wellness and fitness features as growing tenant demands.

Longer term, optimism is high. A significant 16% of respondents expect revenue growth from office investments to increase by 21% to 30% by 2030. And with companies under pressure to offer competitive working environments, those landlords delivering upgraded workspaces are better positioned to attract long-term, high-quality tenants.

As Together’s Chief Commercial Officer Ryan Etchells notes, “Businesses that fail to meet today’s office expectations may find themselves struggling to attract and retain the best talent – losing out to competitors or remote working options.”

Student housing supply gap spells opportunity for landlords

Student lets are once again a hot topic for landlords, particularly in the Purpose-Built Student Accommodation (PBSA) sector. With public university funding falling short and demand from students still running high, the private sector is stepping in to fill the accommodation void.

Together’s report reveals that 81% of industry players consider student housing a strong investment over the next five years. Even more compelling, nearly 10% of those surveyed anticipate revenue growth of between 31% and 40% in that period. Despite a slight dip in student dorm bookings, PBSA remains structurally undersupplied, creating both capital appreciation and yield potential for landlords willing to enter or expand in the space.

Retail’s comeback: High streets, retail parks and logistics hubs

The retail sector is also experiencing a modest revival, with total retail sales growing by 1.4% to £517 billion in 2024 and transaction volumes increasing 0.7%. While e-commerce remains dominant, there is a shift in how investors are viewing physical retail assets.

In fact, 79% of commercial property professionals now consider high streets and retail parks solid investment opportunities, and 83% believe industrial and warehouse spaces offer the best value by 2030. With an anticipated 32% average revenue increase from bricks-and-mortar retail over five years, landlords who capitalise on rising consumer footfall could benefit from enhanced rental yields and asset values.

Etchells adds: “Whether it’s student housing or investing in the future of retail and office space; by 2030 the landscape for the commercial market will have changed and improved exponentially for investors.”

Flexibility is key for landlords and developers

Following a difficult few years, there’s a growing sense that the UK’s commercial property market is entering a more optimistic phase. However, Etchells warns that navigating new regulation and funding constraints requires a flexible, well-informed approach: “Now is the time to support and nurture this growth so it is sustained… with all the new regulations and government plans for property over the last 12 months, there has been a rise in requests for rolling instead of fixed contracts on sites, staggering payments rather than investing upfront and shorter timelines.”

Landlords and developers who work with adaptable lenders and stay ahead of regulatory shifts are likely to find themselves in the best position to benefit from this revival. The landscape may be changing-but for the prepared, the opportunities look more promising than they have in years.