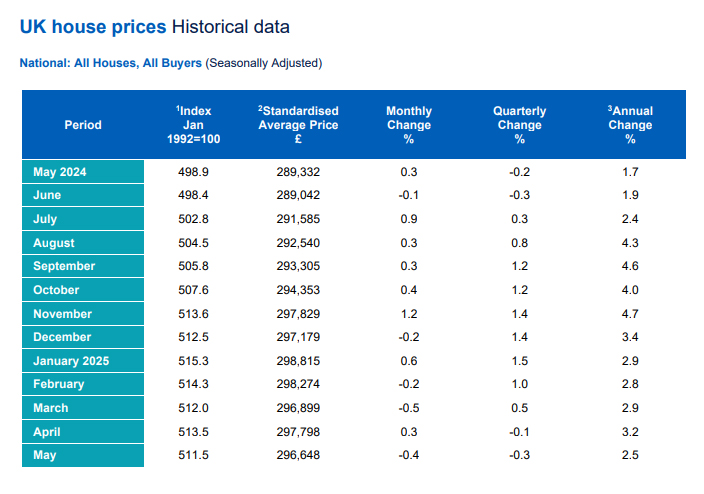

UK house prices recorded a modest decline in May 2025, falling by 0.4%, according to the latest Halifax House Price Index. The average property now stands at £296,648, down just over £1,150 from April. Yet the broader picture remains largely stable, offering reassurance for landlords and property investors navigating what many feared could be a volatile summer.

The annual rate of house price growth slowed to 2.5%, down from 3.2% in April, but the market has shown notable resilience-especially outside the South of England-despite inflationary pressures and interest rate uncertainty.

Regional growth led by northern ireland and the devolved nations

The strongest performers continue to be the devolved regions, with Northern Ireland leading the charge at +8.6% annual growth, where the average property now costs £209,388-well below the UK average, yet growing steadily. Scotland and Wales followed closely behind, both reporting +4.8% annual gains, with average house prices of £214,864 and £230,405, respectively.

By contrast, price growth in London continues to lag at +1.2% year-on-year, though the capital still remains the most expensive UK region, with the average home valued at £542,017. Yorkshire and the Humber and the North West posted a respectable +3.7% annual growth, outperforming much of southern England.

According to Amanda Bryden, Head of Mortgages at Halifax, “These small monthly movements point to a housing market that has remained largely stable, with average prices down by just -0.2% since the start of the year.”

She added: “Affordability remains a challenge, with house prices still high relative to incomes. However, lower mortgage rates and steady wage growth have helped support buyer confidence.”

Stamp Duty hangover and shifting buyer sentiment

The impact of earlier stamp duty incentives is still being felt. Industry insiders, such as Jonathan Hopper, CEO of Garrington Property Finders, said: “Halifax’s figures reveal a market that is listless rather than limping.” He noted that the springtime rush “sucked up huge numbers of would-be buyers,” leaving the current market more subdued.

Hopper added that estate agents in some areas are encouraging sellers to trim prices: “In some cases agents are even refusing to list homes where they feel the owner is asking for an unrealistic price.” However, he also pointed out that “Northern Ireland, Wales and Scotland are recording stronger price growth than England,” thanks to more balanced supply and demand.

HMRC data supports this slowdown in activity, with UK residential transactions in April falling by 63.5% compared to March-dropping from 177,440 to 64,680. Mortgage approvals also dipped by 4.9%, with 60,463 approvals logged in April, according to the Bank of England.

Steady footing offers reassurance to landlords

Despite short-term dips, market sentiment remains cautiously optimistic for landlords. Nathan Emerson, CEO of Propertymark, commented: “This slight dip in house prices will likely have been influenced as a direct consequence to the current state of the global economy… many aspiring or current homeowners will no doubt be discouraged until they feel confident in their long-term affordability.”

Nonetheless, stable wage growth, a slowing inflation trend, and potentially more competitive mortgage products this summer could keep the market on a steady course. “With mortgage interest rates levelling off after several months of gradual falls, the market is settling rather than surging into summer,” Hopper concluded.

The latest Halifax House Price Index was published today.