Rents across England fell for the fourth month in November, with the traditional Christmas slowdown easing short-term pressures while longer-term demand remains resilient. Fresh figures from the Goodlord Rental Index show void periods lengthening and monthly averages cooling, but annual rental inflation still accelerating – a combination shaping investor decisions ahead of 2026.

Seasonal dip but stronger annual momentum

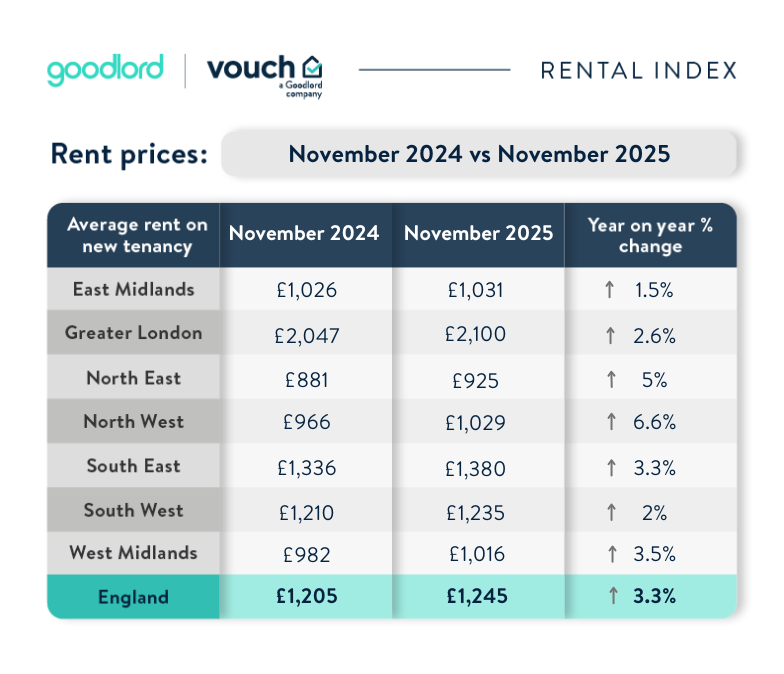

Average rents dropped 2.4% in November, falling from £1,276 to £1,245 and marking the fourth straight monthly decrease. Tenants signing new agreements last month paid around £251 less per month than those who moved at July’s peak, when average rents surged to £1,496.

Greater London saw the steepest monthly shift, with a 4.5% drop, followed by a 4.3% decrease in the North West. The only region to see a rise was the West Midlands, though the average increase was less than £1. Despite the slowdown, agents report that well-presented homes – particularly family properties – are still attracting strong interest even in quieter winter weeks.

Year-on-year rental inflation strengthens despite winter cooling

Annual rental inflation climbed to 3.3% in November, up from 3.1% in October and significantly above September’s 2%. Average rents now sit £40 higher than the same month last year, signalling that underlying demand continues to outweigh available supply.

The North West recorded the strongest annual rise at 6.6%, while the North East followed at 5%. These increases suggest the potential for new rental records in 2026 if supply remains constrained and new regulations add further pressure. Recent ONS figures echo this trend, highlighting persistent demand across most regions.

Voids expand heading into Christmas but remain regionally uneven

Void periods rose from 21 to 24 days during November – a 14% increase consistent with seasonal patterns – and now sit above November 2024’s average of 21 days. The longest voids are found in the West Midlands at 30 days, while London reports the shortest at 20 days, reflecting continued urban demand despite the winter slowdown.

William Reeve, CEO of Goodlord, said the market is displaying “seasonal ebbs and flows”, but the rising pace of annual rental inflation “shows that supply and demand pressures aren’t abating”, warning that new rental records may emerge next year as the Renters’ Rights Act comes into force.

Editor’s view

Seasonal rent dips are entirely expected, but the widening gap between monthly cooling and accelerating annual growth deserves careful attention. Many investors will use the Christmas lull to refinance, adjust pricing, or plan upgrades before demand strengthens again in early 2026. The bigger question is whether policymakers will address the chronic shortage of rental homes that continues to push underlying rents upward.

Author: Editorial team – UK landlord & buy-to-let news, policy, and finance.

Published: 3 December 2025

Sources: Goodlord Rental Index; ONS IPHRP; NRLA commentary; Government statements.

Related reading: Housing slowdown deepens as landlords gain edge in tight rental market