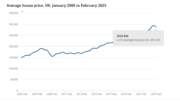

In April, house prices were up 10.8% in a year, to a record high average of £286,079. They’re up £47,568 in two years. It took the previous five and a half years for the market to rise this much.

‘So far, our long-lasting love affair with property has held firm in the face of adversity. Despite seemingly endless trials and tribulations, our commitment to buying a new home has proven unassailable. The question is how much more we can take before our passion fades, because inflation hitting 10% later this year risks cooling our ardour.

The undying commitment of buyers, and the dearth of properties on the market, lies behind the eye-watering price rises. Zoopla figures earlier this week showed that the demand for property remains 58% above the five-year average.

There are still good reasons why buyers are so committed. There are plenty with lockdown savings they want to make the most of. They recognise this could be the biggest lump sum they build up for some time, and they don’t want to lose the opportunity to use it.

Meanwhile, although mortgage rates are rising, they haven’t reached the kinds of levels that prove repellent. The Banks have enough cash in the coffers to keep rises to a minimum, so despite the Bank of England raising rates 0.9 percentage points since December, the average mortgage rate is trailing well behind.

Rising prices themselves play a part, because buyers feel that sitting tight will just mean the property of their dreams rises further out of reach. If they’re looking for a first property, soaring rents are also a good motivator, because they make the relative costs of buying seem like a bargain.

However, inflation at 10% later this year may start to deter buyers, as more people struggle with bills, eat into their savings, and realise a new home is too much of a stretch. Even those who remain keen may find that tougher affordability calculations – factoring in higher bills – push properties out of reach. This change won’t happen overnight, and it’s going to mean a gradual slowing of house price rises as our passion for property dims, rather an anything more dramatic’, said Sarah Coles, senior personal finance analyst at Hargreaves Lansdown.

Emma Cox, MD of Real Estate at Shawbrook, commented: ‘House price growth has remained exceptionally strong because of high demand and a shortage of housing stock. A large proportion of people are still looking to move this year, with determined buyers acting quickly to secure their purchases.

However, the squeeze on household budgets and higher borrowing costs are likely to lead to a cooling off in the quarters ahead. Consumer confidence is suffering from the prospect of even higher energy prices and the effects of the war in Ukraine. With more rate rises from the Bank of England on the horizon this will put pressure on mortgage affordability, forcing many homebuyers to review their budgets.

Despite market pressures, house prices remain at the highest level on record, with annual growth in double-digits. Lenders are continuing to offer new products, flexible rates and attractive LTVs to support the needs of homebuyers and buy-to-let investors.

It is also essential for landlords and developers to receive the right support from the government to contribute quality, affordable properties to the housing stock’.

The Halifax House Price Index for April was released today.