December’s rental data shows UK rent growth rising 2% year-on-year, according to the latest Goodlord Rental Index, but softer demand and seasonal slowdown pushed monthly prices to a nine-month low. For landlords, it’s a reminder of how quickly yields can fluctuate in a market already under policy pressure.

Rent inflation eases

Average rents in England reached £1,214 in December 2025 – 2.4% higher than the £1,185 recorded the previous year. That uplift is considerably calmer than the 4.6% annual increases seen in January and March 2025 and also below the 3.3% annual rise recorded in December 2024, according to historic Goodlord data.

In plain terms, annual rent growth is still positive but no longer racing ahead. Some of the cooling is almost certainly seasonal; rental inflation had begun to re-accelerate from September after a slow summer. For investors, this hints that underlying demand has not disappeared – it has simply paused for winter.

Letting agents in the Midlands report the same trend. One agent told industry press that enquiry levels “fell sharply after mid-November but remain higher than normal for December,” an observation that aligns with the modest year-on-year gains.

With inflation calming and mortgage rates drifting down from their 2023 highs, many landlords will welcome steadier month-to-month figures even if yields remain under pressure from rising costs.

Regional rents and void periods offer mixed signals

Month-on-month, December rents dipped 2.5%, falling from £1,245 to £1,214 – a drop of £31 a month (£372 a year) for a typical new tenancy. Rents haven’t sat this low since March 2025.

The South West saw the sharpest monthly fall at 4%, while the North West was the only region to record any increase, though a marginal one at 0.3%. July remained the year’s high-water mark at £1,496, meaning December rents ended 19% below the summer peak. For tenants signing a new contract, that difference equates to a striking £3,384 less per year.

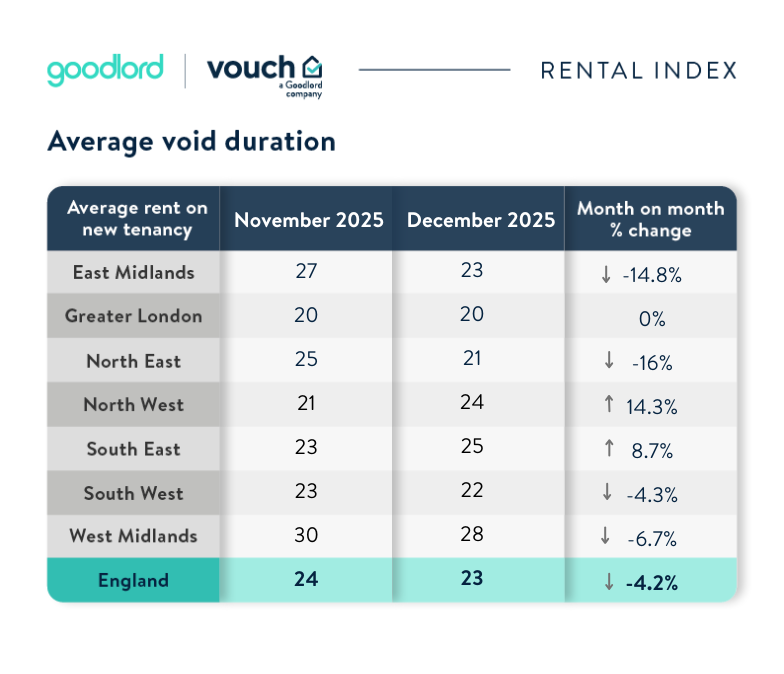

Void periods held steady at 23 days, down slightly from November but longer than the 21-day average logged in December 2024. Regionally, voids shortened in the East Midlands, North East, South West and West Midlands, held firm in London, and lengthened in the South East and North West.

Slightly longer voids signal that pricing strategy and property presentation will matter more in early 2026, especially outside major cities.

Legislation and the 2026 rental market forecast

Goodlord CEO William Reeve notes that a small dip in December rents is entirely typical but stresses the significance of the annual figures:

“Despite ending the year up 2%, December’s annual inflation figures are far lower than we’ve seen in previous years and lower still compared to 2025’s inflationary peak of 4.6%,” he said. “With the Renters’ Rights Act coming into force in May, we could see further pressure on supply if landlords leave the sector, setting up another intense year for the market.”

The industry widely expects regulatory change to constrain available stock. The NRLA has repeatedly warned that ongoing tax burdens and legislative shifts are incentivising landlord exit. If this trend continues into the summer – traditionally the busiest letting season – rental inflation could accelerate again, even from the lower December base.

For buy-to-let investors with stable financing, 2026 may present an opportunity: softer winter rents could broaden acquisition prospects before heightened summer competition returns.

Editor’s view

This winter’s softer rental numbers won’t last long. The underlying imbalance between supply and demand hasn’t gone away – it has merely been masked by December’s slowdown. With May’s Renters’ Rights Act threatening to tighten the market further, landlords who remain invested, diversified, and well-financed may be best placed to benefit from another year of rising tenant demand.

Author: Editorial team – UK landlord & buy-to-let news, policy, and finance.

Published: 7 January 2026

Sources: Goodlord Rental Index; ONS rental price data; NRLA statements; industry press.

Related reading: Rent growth slows as supply rises but investors eye 2026 uplift