Rents across the UK continued to rise in November, but at a slower pace, according to new ONS data that signals a cooling rental market at the very moment many landlords face higher tax bills and tightening regulation. Annual rent growth dipped to 4.4%, easing from 5% in October, yet affordability pressures and supply shortages remain entrenched.

Rent growth outlook: regional gaps widen

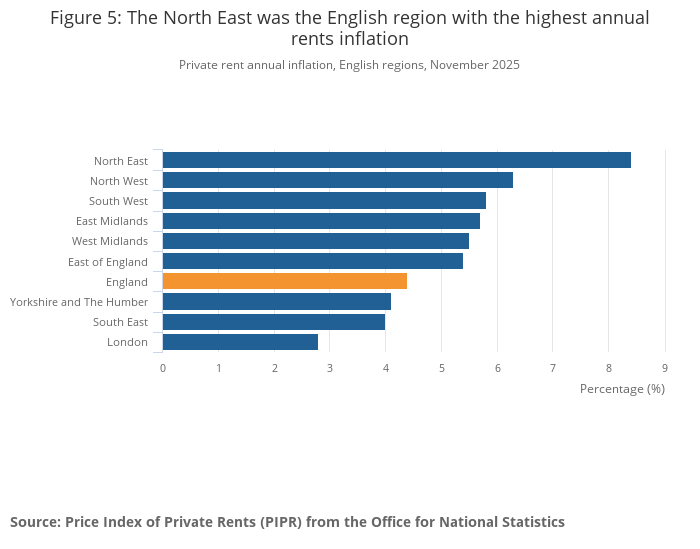

The ONS figures show the average UK monthly rent reached £1,366, up £58 on the year. England recorded annual rent inflation of 4.4%, Wales 6.1%, Scotland 3.3%, and Northern Ireland 6.4%. The North East again topped England’s growth chart with 8.4%, while London saw only 2.8%, its twelfth consecutive month of deceleration.

For landlords, this divergence matters. Slower London growth reflects a post-pandemic rebalancing, while Northern markets continue to deliver the strongest percentage gains relative to capital values, supporting yield-focused investors. Even so, the ONS stresses Scotland and Northern Ireland data are based mainly on advertised new lets, making comparisons trickier during a period of in-tenancy controls.

At local level, the gap is even wider: Kensington and Chelsea averaged £3,634 per month, versus £535 in Dumfries and Galloway. Detached homes pushed the top of the scale to £1,559, while flats averaged £1,335.

Alex Upton, Managing Director for Specialist Mortgages & Bridging at Hampshire Trust Bank, said the moderation in rent rises does not remove the strain on landlords. He warned that government tax changes could hit 2.4 million property owners by the end of this Parliament, adding that some are “considering calling time on their portfolios”.

House price trends: modest gains but shifting sentiment

Average UK house prices rose 1.7% to £270,000 in the year to October, softening slightly from September’s 2%. England reached £292,000, Wales £211,000, and Scotland £192,000, with Northern Ireland up 7.1% year-on-year in Q3 at £193,000.

Chris Storey, Chief Commercial Officer at Atom bank, highlighted that despite steady price growth, affordability has actually improved. Citing Halifax analysis, he noted that price-to-income ratios are at their strongest since 2015, supporting expectations that falling interest rates in 2026 could lift demand further. He also urged lenders to widen access for borrowers with small deposits, self-employed incomes or imperfect credit.

The return of first-time buyers may soften rental demand in some areas, yet it also supports a more balanced housing ecosystem. A stronger sales market creates additional exit opportunities and greater flexibility for those looking to adjust or streamline portfolios.

Buy-to-let market pressures: tax, reform and investment shifts

ONS figures underscore a market in transition. Slowing rental inflation may relieve political heat, but rising taxes, energy standards and tenancy reform continue to reshape investment strategies.

Upton said landlords are increasingly shifting into HMOs, mixed-use assets and semi-commercial units. The move is “not just about chasing yield but about staying in a sector that is getting harder to navigate”. He cautioned that without recognising the cumulative impact of policy changes, the market risks weakening further.

Garrington Property Finders CEO Jonathan Hopper added that October’s price softness reflected the pre-Budget pause, not an enduring slump. He expects buyer activity to rebound sharply through early 2026, helped by greater stock levels and cheaper mortgages. That could support capital values but also sharpen competition for good-quality properties.

For now, landlords continue to bear the brunt of supply-demand imbalances. Many are reassessing mortgage products, rent strategies and portfolio mixes well ahead of the Renters’ Rights Act coming into full force.

Editor’s view

Cooling rent inflation may look like a turning point, but pressure on landlord finances is still building. With tax liabilities rising and regulatory complexity deepening, 2026 will reward investors who diversify, plan early and actively manage risk. The question is whether policymakers recognise the limits before the sector’s capacity to house growing numbers of tenants is materially weakened.

Author: Editorial team – UK landlord & buy-to-let news, policy, and finance.

Published: 17 December 2025

Sources: ONS; Halifax; UK Finance; comments from Hampshire Trust Bank, Atom bank, Garrington Property Finders

Related reading: House prices hold ground as annual growth eases into year end