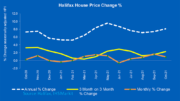

UK house prices rose for the third consecutive month in August, with Halifax reporting a 0.3% increase that pushed the average home to £299,331. Prices are now 2.2% higher than a year ago, though the annual growth rate has slowed from July’s 2.5%. For landlords, the figures highlight a resilient market but one clouded by uncertainty over potential property tax changes in the Autumn Budget.

Steady growth but regional contrasts remain

Halifax’s data shows national house prices have crept up by less than £600 since January, a modest return compared with the rapid gains seen in previous years. While London and its commuter belt are showing small increases, some regions are still under pressure.

Jonathan Hopper, CEO of Garrington Property Finders, noted: “Average prices fell by 0.8% in South West England over the past 12 months, as large numbers of second homes and holiday let properties were put up for sale by their disenchanted owners. Prices have been creeping up in London and the commuter belt, but by tiny amounts. Northern Ireland and Scotland are still seeing prices rise at a decent clip, but overall the market is settling into a period of modest price growth.”

For buy-to-let investors, this divergence matters. Holiday let owners exiting the market could create opportunities in tourist-heavy regions, while steady rises in Scotland and Northern Ireland may sustain better long-term yields.

Landlords brace for tax and regulatory shifts

Commentary around the Autumn Budget looms large. Rumours suggest potential reforms to Stamp Duty and even changes to Capital Gains Tax. Nathan Emerson, CEO of Propertymark, cautioned: “The latest announcements from the UK Government about reforming Stamp Duty and charging landlords with National Insurance contributions ahead of the next Budget will continue to add further uncertainty for many potential buyers and sellers. This may delay moving plans for a number of people until they know for sure what is likely to happen next.”

For landlords, tax unpredictability adds another layer of risk to portfolio planning. Many are weighing whether to expand holdings before November or sit tight until fiscal policy is clearer. One London landlord told us: “We can handle slow growth, but not if the Chancellor keeps moving the goalposts. Stamp Duty changes could make or break whether I invest further this year.”

Mortgage affordability supports cautious confidence

Interest rate reductions and improved mortgage products are quietly underpinning activity. Steve Griffiths, Commercial Director for Retail Mortgages at Shawbrook, said: “House prices continued to heat up alongside summer temperatures, driven by the slow but steady fall in interest rates and continued rises in wage growth. This is especially welcome news for mortgage holders coming to the end of fixed rate deals, who will likely benefit from the lower mortgage rates and feel encouraged by the resilience of the property market against wider economic uncertainty.”

Guy Gittins, CEO of Foxtons, added that improved affordability is filtering through: “Following interest rate reductions, improving mortgage affordability and the increasing number of higher loan-to-income ratio products available, we’re now seeing the uplift in mortgage market activity begin to convert into transactional growth.”

For landlords, that means prospective tenants may feel more confident buying - but not in the volumes needed to ease rental pressure. Supply remains constrained, and many renters will stay in the private sector for longer, keeping yields firm even as prices grow only modestly.

Editor’s view

Three months of steady house price growth show the property market is stabilising, but for landlords the real story lies in policy risk. Mortgage affordability is improving, rental demand remains strong, yet tax uncertainty is casting a long shadow. The Autumn Budget could determine whether landlords lean back into expansion or retreat further from buy-to-let.

The Halifax House Price Index for August 2025 was released today: House prices continue to rise at a steady pace